etf bitcoin quali sono opens up an exciting dialogue about the intersection of traditional finance and digital assets, making it an essential read for those curious about investing in Bitcoin without the complexities of direct ownership.

Bitcoin ETFs, or exchange-traded funds, represent a way for investors to gain exposure to Bitcoin’s price movements through regulated financial products. These ETFs offer a simplified investment route, catering to both seasoned investors and newcomers alike, while showcasing various types that each come with distinct advantages.

Introduction to Bitcoin ETFs

Bitcoin ETFs, or Exchange-Traded Funds, are investment vehicles that allow individuals to invest in Bitcoin without directly owning the cryptocurrency. These funds are traded on stock exchanges, making them accessible to a broader audience who may not be comfortable dealing with the complexities of cryptocurrency wallets and exchanges. Essentially, a Bitcoin ETF holds Bitcoin as its underlying asset, and its shares represent a fraction of the Bitcoin owned by the fund.Investing in Bitcoin ETFs offers several advantages over direct Bitcoin purchases.

Firstly, they provide a more straightforward way to gain exposure to Bitcoin’s price movements without the need for managing private keys or wallets. Additionally, Bitcoin ETFs can be bought and sold like stocks, enhancing liquidity. Different types of Bitcoin ETFs exist, including physically-backed ETFs, which hold actual Bitcoin, and futures-based ETFs, which invest in Bitcoin futures contracts.

How Bitcoin ETFs Work

The structure of Bitcoin ETFs revolves around their ability to track the price of Bitcoin. When you invest in a Bitcoin ETF, you are purchasing shares in a fund that manages Bitcoin assets. This fund employs custodians to securely hold the Bitcoin and exchanges to facilitate the buying and selling of ETF shares. For investors, buying shares of a Bitcoin ETF is akin to purchasing shares of any stock—simply place an order through a brokerage account.

The fund then handles the underlying Bitcoin transactions and custodial services. This streamlined process allows investors to bypass the complexities of cryptocurrency exchanges while still benefiting from Bitcoin’s price appreciation.

Advantages of Bitcoin ETFs

Investing in Bitcoin ETFs provides several key advantages for investors. These include:

- Ease of Access: Bitcoin ETFs are available on traditional stock exchanges, allowing investors to buy and sell shares without needing to set up a cryptocurrency exchange account.

- Tax Efficiency: Investors may find Bitcoin ETFs more tax-efficient compared to direct Bitcoin transactions, especially regarding capital gains reporting and tax implications.

- Regulatory Clarity: Bitcoin ETFs typically operate under established regulatory frameworks, providing a level of security and oversight not always present in the cryptocurrency market.

- Liquidity: The ability to quickly buy and sell shares on the stock market can lead to greater liquidity than holding Bitcoin directly, especially during volatile market conditions.

Risks Associated with Bitcoin ETFs

While Bitcoin ETFs present appealing investment opportunities, they are not without risks. The potential risks include:

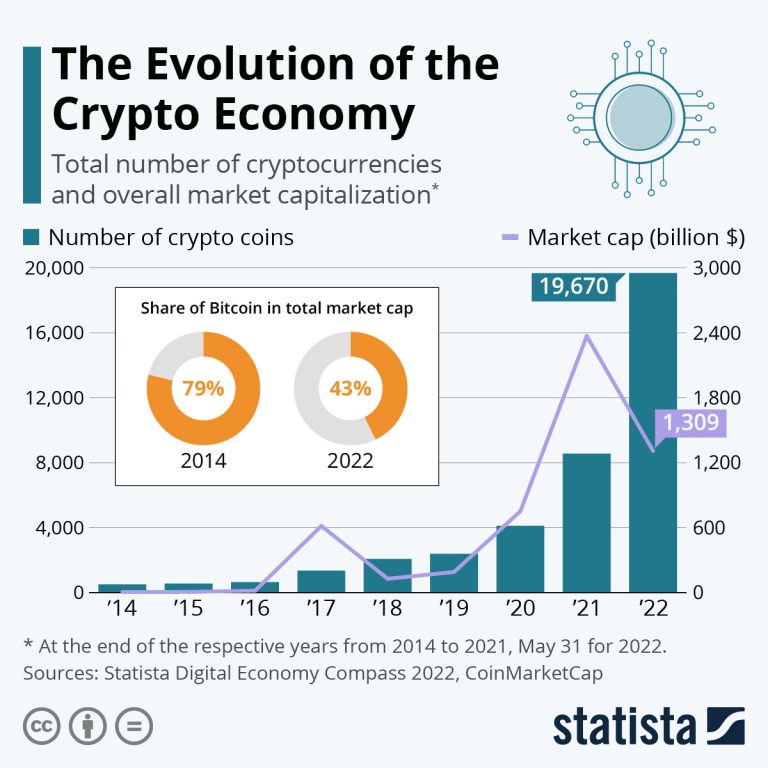

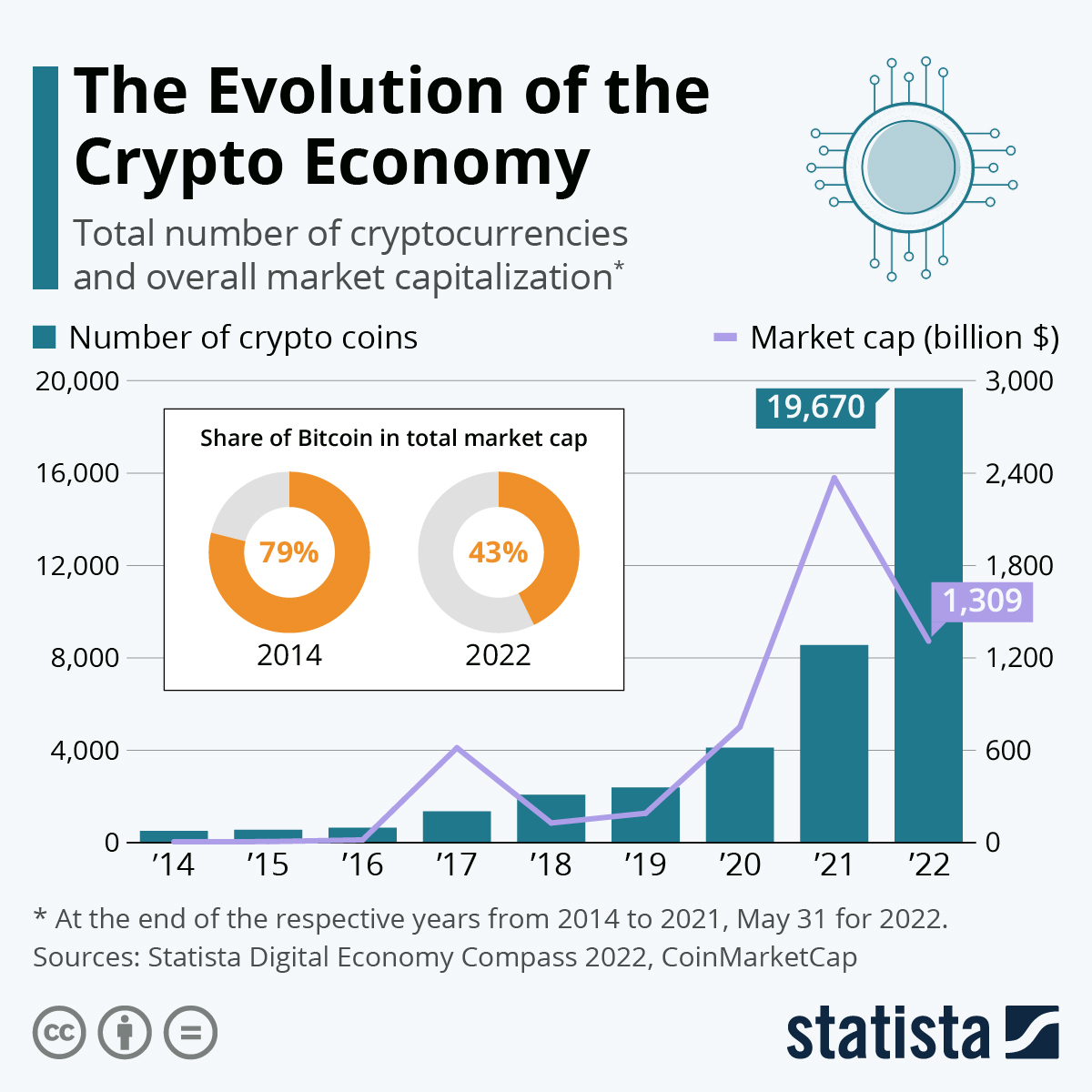

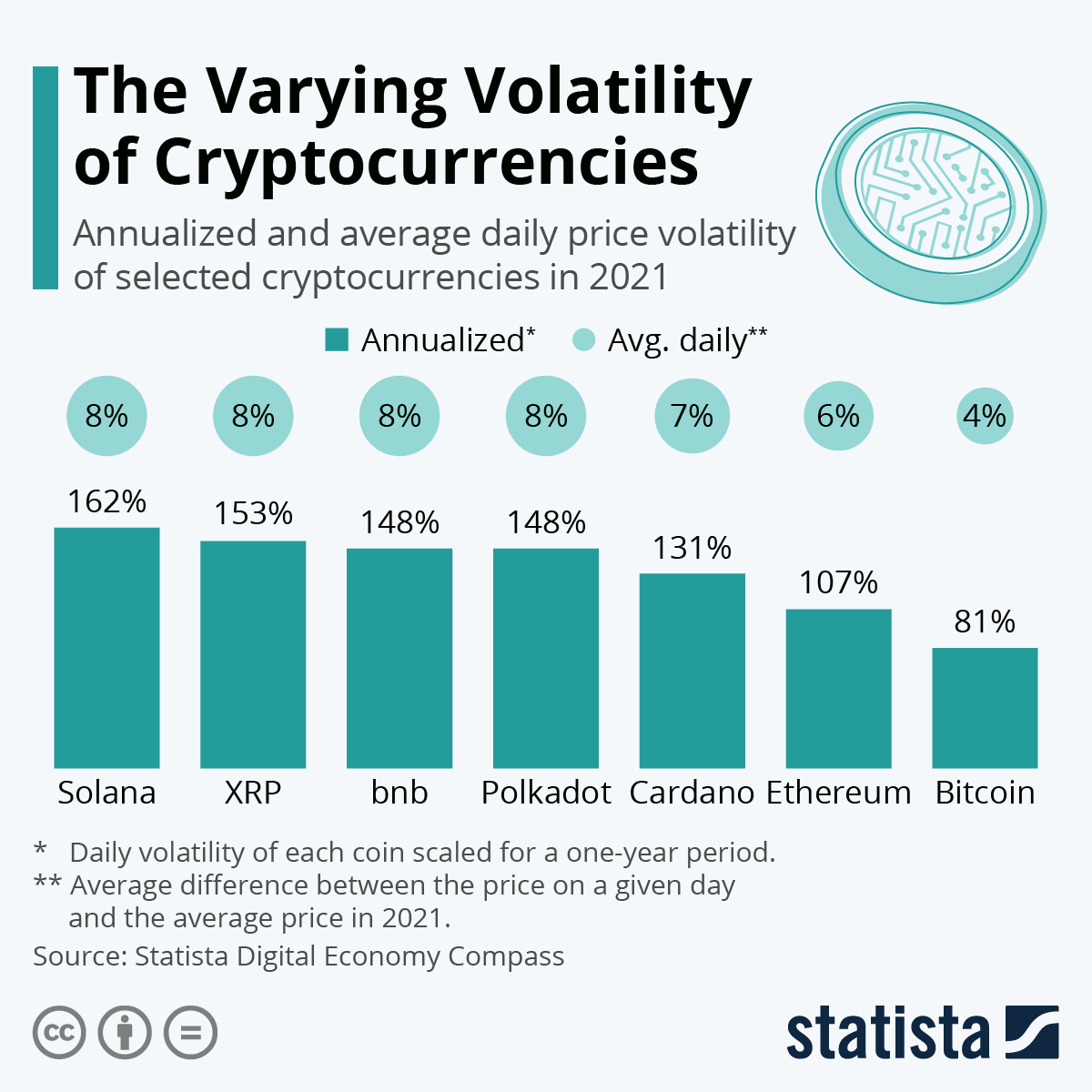

- Market Volatility: Bitcoin prices are notoriously volatile, which means Bitcoin ETF values can fluctuate widely, directly impacting investors’ portfolios.

- Regulatory Risks: Changes in regulations can impact the operation and legality of Bitcoin ETFs, leading to potential disruptions in trading.

- Management Fees: Bitcoin ETFs incur management fees that can erode investment returns over time, particularly in a flat or declining market.

How to Choose a Bitcoin ETF

Selecting the right Bitcoin ETF requires careful evaluation. Investors should consider criteria such as:

- Fees: Review management fees and other costs associated with the ETF.

- Performance: Look into the historical performance of the ETF compared to Bitcoin’s price movements.

- Fund Management: Assess the track record and credibility of the fund’s management team.

A comparison table of popular Bitcoin ETFs can provide valuable insights into their respective fees, performance, and management styles. This allows investors to make informed decisions and tailor their investments according to their financial goals.

Future Trends in Bitcoin ETFs

The future of Bitcoin ETFs looks promising with potential growth and evolution on the horizon. Key trends include:

- Integration of Emerging Technologies: Innovations such as blockchain technology can enhance the efficiency and transparency of Bitcoin ETF operations.

- Increased Market Adoption: As more investors seek exposure to cryptocurrencies, Bitcoin ETFs may see greater demand, leading to the introduction of new products.

- Market Indicators: Factors like institutional investment, regulatory advancements, and overall market sentiment will continue to play significant roles in shaping the future landscape of Bitcoin ETFs.

Best Practices for Investing in Bitcoin ETFs

To effectively invest in Bitcoin ETFs, consider the following strategies:

- Diversification: Spread investments across different Bitcoin ETFs to mitigate risks and capture various market opportunities.

- Regular Monitoring: Keep a close eye on market trends, ETF performance, and news regarding Bitcoin and its regulatory environment.

- Long-Term Perspective: Approach Bitcoin ETF investments with a long-term view to ride out short-term volatility while capitalizing on potential growth.

Last Recap

In conclusion, understanding etf bitcoin quali sono equips you with the knowledge needed to navigate the evolving landscape of Bitcoin investments. As this market continues to grow, being informed about the benefits, risks, and best practices will enhance your investment strategy and potentially lead to greater financial success.

FAQ Resource

What is a Bitcoin ETF?

A Bitcoin ETF is an investment fund that tracks the price of Bitcoin, allowing investors to trade shares on stock exchanges without directly owning Bitcoin.

How do I invest in a Bitcoin ETF?

You can invest in a Bitcoin ETF through a brokerage account, just like you would with any stock or mutual fund.

Are Bitcoin ETFs safe?

While Bitcoin ETFs are regulated, they still come with market risks and potential regulatory changes that can impact their value.

Can I hold a Bitcoin ETF in my retirement account?

Yes, many Bitcoin ETFs can be held in tax-advantaged accounts like IRAs, allowing for potential tax benefits.

What are the fees associated with Bitcoin ETFs?

Fees vary by ETF but typically include management fees and expense ratios, which can affect your overall returns.