Bitcoin que significa en español serves as a gateway to understanding one of the most revolutionary financial technologies of our time. As the world shifts toward digital currencies, Bitcoin stands out not only as a pioneer but also as a symbol of the potential for decentralized financial systems. This exploration delves into its origins, significance, and how it continues to impact economies, particularly in Spanish-speaking countries.

The narrative of Bitcoin is rich with technological advancements, socio-economic implications, and cultural interpretations. Understanding its meaning in Spanish sheds light on its relevance, adoption, and the evolving regulatory landscape that shapes its use in various regions.

Understanding Bitcoin

Bitcoin is a decentralized digital currency that was introduced in 2009 by an individual or group known as Satoshi Nakamoto. Its creation marked a significant step toward the modernization of financial transactions, enabling peer-to-peer exchanges without the need for a central authority or intermediary. The technological marvel behind Bitcoin is blockchain technology, a secure and transparent ledger that records all transactions across a network of computers.

Concept and Origin of Bitcoin

The idea behind Bitcoin was to create a currency that would operate independently of traditional financial institutions. This independence is made possible through blockchain technology, which allows for a tamper-proof record of transactions. Each transaction is verified by network nodes and recorded in a public distributed ledger. This system not only ensures the integrity of transactions but also provides transparency and reduces the risk of fraud.

Technological Framework

Blockchain technology serves as the backbone of Bitcoin, consisting of a chain of blocks, each containing transaction data. Each block is linked to the previous one, creating a secure chain that is virtually impossible to alter without consensus from the network. This innovation provides a level of security and trust that traditional currencies cannot offer.

Differences Between Bitcoin and Traditional Currencies

Bitcoin differs from traditional currencies in several key ways:

- Decentralization: Unlike traditional currencies which are controlled by governments and central banks, Bitcoin operates on a decentralized network.

- Supply Limit: Bitcoin has a capped supply of 21 million coins, contrasting with fiat currencies which can be printed in unlimited quantities.

- Anonymity: Transactions made with Bitcoin can offer a degree of anonymity not found in traditional banking systems.

- Global Accessibility: Bitcoin can be accessed by anyone with an internet connection, making it a valuable tool in regions with limited banking infrastructure.

The Meaning of Bitcoin in Spanish

In Spanish, “Bitcoin” is translated directly as “Bitcoin,” retaining its original name. However, the interpretation can vary depending on the context. In financial discussions, it often signifies innovation and investment opportunities, while in everyday conversations, it might represent a means of transaction or a speculative asset.

Relevance in Spanish-speaking Countries

Bitcoin holds significant relevance in many Spanish-speaking countries, particularly those facing economic instability or high inflation rates. Countries like Venezuela and Argentina have seen increased Bitcoin adoption as individuals seek alternatives to devaluing local currencies.

Common Spanish Terms Related to Bitcoin

Several Spanish phrases are commonly associated with Bitcoin:

- Criptomoneda: Refers to cryptocurrencies in general, including Bitcoin.

- Monedero Digital: Digital wallet used to store Bitcoin and other cryptocurrencies.

- Minar: The process of mining Bitcoin, involving solving complex mathematical problems.

The Importance of Bitcoin

Bitcoin is becoming an increasingly important player in the global economy, shaping financial landscapes and investment strategies. Its decentralized nature and finite supply give it unique characteristics that set it apart from traditional currencies and other investments.

Significance in the Global Economy

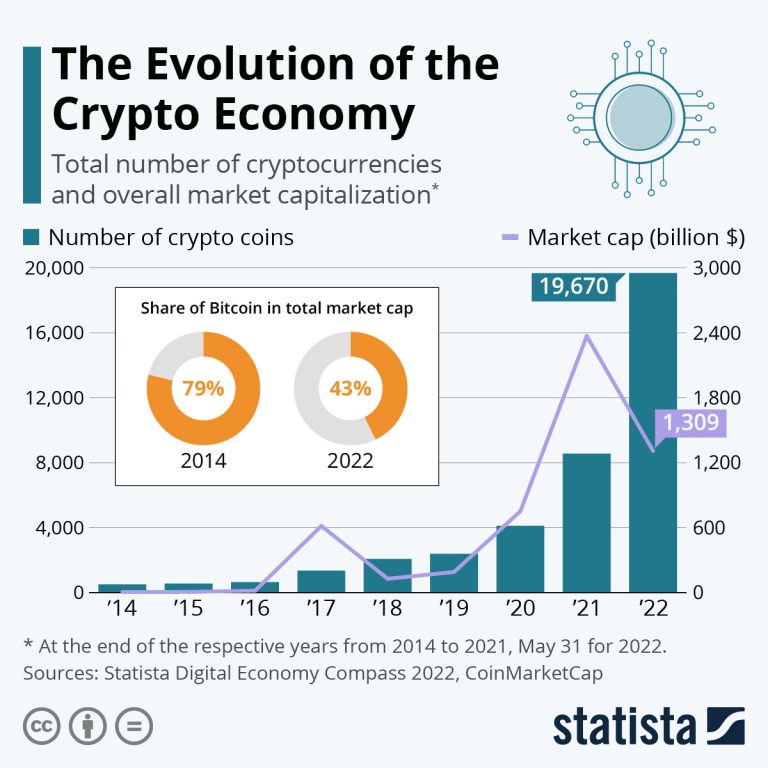

Bitcoin’s market capitalization has grown exponentially, making it a significant asset class that attracts both institutional and retail investors. Its potential to act as a hedge against inflation is gaining recognition, especially in uncertain economic climates.

Changing the Financial Landscape

Bitcoin is changing the financial landscape by introducing new models of transaction and investment. It is disrupting traditional banking systems, fostering innovation in payment processing, and influencing how value is transferred globally.

Comparison with Other Cryptocurrencies

Compared to other cryptocurrencies, Bitcoin remains the most influential. It has set the standard for market impact and adoption rates. While newer cryptocurrencies often offer advanced features, Bitcoin’s first-mover advantage and established network effect keep it at the forefront of the market.

Bitcoin Usage and Adoption

Bitcoin adoption is on the rise globally, particularly in regions where traditional banking services are lacking. Understanding where and how Bitcoin is being utilized can provide insight into its growth trajectory.

Countries with High Adoption Rates

Countries exhibiting high Bitcoin adoption rates include:

- Venezuela

- Argentina

- Mexico

- Colombia

These nations have embraced Bitcoin as a means to bypass economic challenges and improve financial accessibility.

Integration into Business Operations

Businesses in Spanish-speaking regions are increasingly integrating Bitcoin into their operations. This includes accepting Bitcoin as payment, using it for remittances, and investing in Bitcoin as a long-term asset. This shift is indicative of a growing acceptance of cryptocurrencies in mainstream commerce.

Demographic Trends in Latin America

The demographic trends associated with Bitcoin users in Latin America reveal a diverse user base. Younger generations, particularly millennials and Gen Z, are more inclined to adopt Bitcoin, often driven by a desire for financial independence and innovation.

Bitcoin Regulations in Spanish-speaking Countries

Regulatory approaches to Bitcoin vary widely among Spanish-speaking countries, impacting how it is traded and used.

Summary of Regulatory Approaches

A summary of regulatory approaches includes:

- Venezuela: The government has embraced cryptocurrency, facilitating the use of Petro while regulating Bitcoin trading.

- Argentina: Bitcoin is largely unregulated but is recognized for tax purposes.

- Mexico: The country has implemented a regulatory framework that includes anti-money laundering measures for cryptocurrency exchanges.

Implications of Regulations

Regulations can have significant implications on Bitcoin trading and usage, affecting market liquidity and investor confidence. Clear regulations can encourage institutional investment, while overly restrictive measures may stifle innovation and growth.

Successful Regulatory Frameworks

Examples of successful regulatory frameworks include:

- Chile, which has established guidelines that promote innovation while protecting consumers.

- Mexico, with regulations that support the operational integrity of exchanges.

Future of Bitcoin

The future of Bitcoin is a subject of much speculation and analysis among experts and investors alike.

Predictions on Future Trends

Predictions regarding the future trends of Bitcoin suggest that it may continue to gain traction as a legitimate form of currency and investment. As institutional adoption increases, Bitcoin could solidify its position in the financial mainstream.

Potential Challenges

Despite its promising future, Bitcoin faces potential challenges such as regulatory scrutiny, technological vulnerabilities, and competition from other cryptocurrencies. Addressing these challenges will be crucial for its sustained growth and acceptance.

Expert Opinions on Trajectory

Expert opinions on Bitcoin’s trajectory in Spanish-speaking economies highlight a mix of optimism and caution. While many experts foresee significant growth, they also emphasize the need for a balanced regulatory approach to maximize benefits while mitigating risks.

Resources for Learning about Bitcoin in Spanish

For those seeking to deepen their understanding of Bitcoin, a variety of resources are available in Spanish.

Books, Articles, and Websites

A compilation of resources includes:

- Libros: “El Bitcoin: Una guía sencilla” by José Luis C. D. and “Criptomonedas para Dummies.”

- Artículos: Financial news websites such as “El Economista” and “Forbes España” regularly cover Bitcoin topics.

- Sitios web: Websites like “Cointelegraph en Español” and “CriptoNoticias” provide updates and in-depth information.

Online Courses and Webinars

Many online platforms offer courses in Spanish focusing on Bitcoin:

- Coursera: Offers courses on blockchain and cryptocurrency basics.

- Udemy: Features various courses tailored to Bitcoin investing and trading.

Bitcoin-related Podcasts

A guide to Bitcoin-related podcasts in Spanish includes:

- Bitcoin en Español: A podcast focused on Bitcoin news and education.

- Cripto Podcast: Discusses trends and developments in the cryptocurrency space.

Epilogue

In conclusion, Bitcoin que significa en español encapsulates a broader movement toward digital finance that is poised to alter how we perceive money and transactions globally. As we navigate through its implications, we recognize the importance of education and regulatory frameworks in ensuring its sustainable growth. The future of Bitcoin looks promising, especially in Spanish-speaking regions where its impact is increasingly felt.

General Inquiries

What does Bitcoin mean in Spanish?

Bitcoin translates directly to “Bitcoin” in Spanish, but it is often discussed in the context of its financial significance and technological impact.

Is Bitcoin legal in Spanish-speaking countries?

Legal status varies by country; some fully accept it, while others impose restrictions or outright bans.

How can I buy Bitcoin in Spanish-speaking regions?

You can purchase Bitcoin through cryptocurrency exchanges, peer-to-peer platforms, and Bitcoin ATMs available in various locations.

What are the risks of investing in Bitcoin?

Risks include market volatility, regulatory changes, and potential security issues related to online transactions.

Are there any Bitcoin education resources in Spanish?

Yes, there are numerous books, articles, courses, and podcasts available in Spanish dedicated to educating users about Bitcoin and cryptocurrency.